1. Understand Market Sentiment

Market sentiment is the overall mood of traders and investors toward Dogecoin. It heavily influences short-term price movements.

Example:

- Positive Sentiment: In May 2021, when Elon Musk tweeted about Dogecoin, the price skyrocketed by over 100% in a few days.

- How to Monitor Sentiment:

- Use tools like LunarCrush or CryptoPanic to track news and social media trends.

- Watch for trending hashtags like #Dogecoin on Twitter or mentions in forums like Reddit’s r/cryptocurrency.

2. Use Technical Analysis (with Examples)

Technical indicators can help predict price movements. Here’s a detailed breakdown:

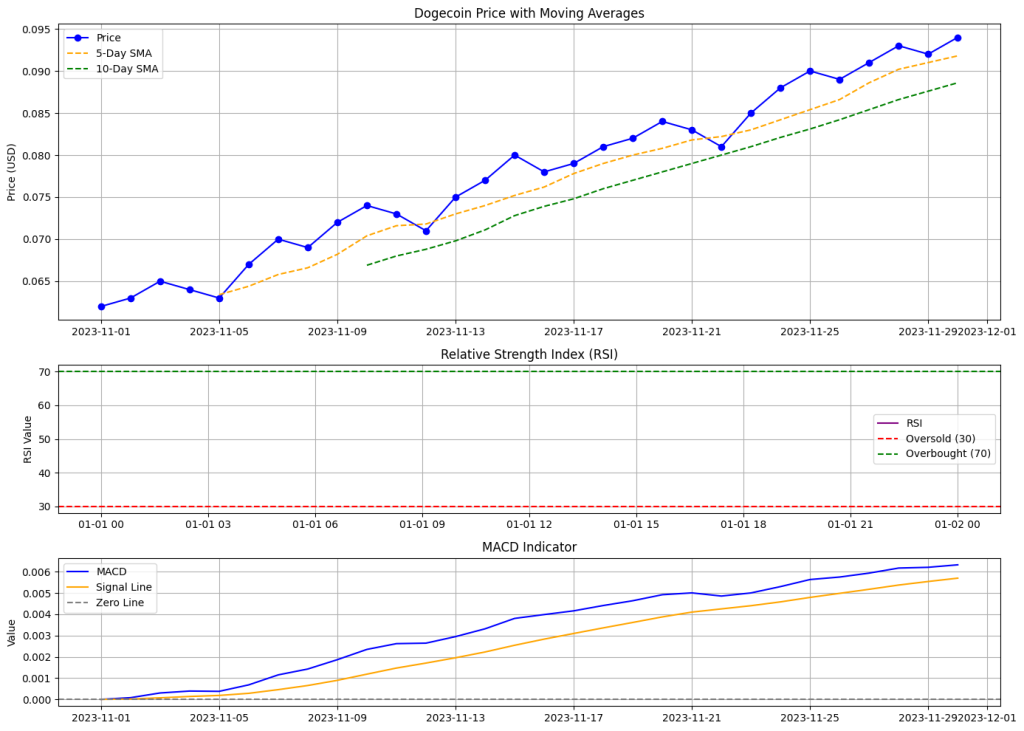

A. Moving Averages Moving averages smooth price data to identify trends.

- Golden Cross Example:

- In April 2021, Dogecoin’s 50-day MA crossed above the 200-day MA (Golden Cross), signaling a bullish trend. The price rose significantly afterward.

Chart Visualization:

- On a trading platform like TradingView, plot the 50-day and 200-day moving averages.

- Look for the crossover to confirm a potential buy signal.

B. Relative Strength Index (RSI) RSI indicates whether a cryptocurrency is overbought or oversold (ranges between 0 and 100).

- RSI Below 30:

- Example: In July 2021, Dogecoin’s RSI fell to 25, suggesting it was oversold. Shortly after, the price rebounded by 15% within a week.

- How to Use It:

- On platforms like Binance or MetaTrader, apply the RSI indicator.

- Buy when the RSI is near 30 and showing an upward curve.

C. MACD (Moving Average Convergence Divergence) MACD reveals momentum changes in a trend.

- Buy Signal Example:

- In February 2021, Dogecoin’s MACD line crossed above its signal line, indicating bullish momentum. The price increased by 20% in the following days.

- How to Spot:

- Look for the crossover in the MACD chart, ideally accompanied by rising trading volume.

D. Support and Resistance Levels Support is a price level where demand is strong enough to prevent further declines, while resistance is where selling pressure prevents further rises.

- Support Example:

- In June 2021, Dogecoin repeatedly bounced back from the $0.16 support level. Traders who bought near this level saw gains as it climbed back to $0.25.

- How to Identify:

- Use horizontal lines on a chart to mark areas where the price frequently reverses.

3. Spot Patterns in Charts

Common Patterns to Recognize:

- Bullish Engulfing Pattern:

- Indicates a potential price reversal. Look for a green candlestick that completely engulfs the previous red candlestick.

- Breakout Example:

- In March 2021, Dogecoin broke above a resistance level of $0.05 with strong volume. This breakout signaled a buy opportunity, and the price surged to $0.07.

4. External Factors

Dogecoin is highly sensitive to external factors like celebrity tweets, regulatory news, or Bitcoin price movements.

Example:

- In December 2020, Dogecoin’s price spiked after TikTok users encouraged buying DOGE to hit $1. Those who bought early saw profits as the price rose.

5. Combine Signals for a Strong Buy

A good signal typically involves multiple factors aligning:

- RSI is below 30.

- MACD shows a bullish crossover.

- Price is near a strong support level.

- Volume is increasing.

- Positive news or social media buzz is driving interest.

To view and analyze charts like the one I just showed you, you can use various applications and platforms that offer technical analysis tools. Here’s a list of popular platforms where you can track Dogecoin and apply indicators like RSI, MACD, and moving averages:

1. TradingView

- Website: TradingView

- Features:

- Free and premium accounts with powerful charting tools.

- You can add various technical indicators, including RSI, MACD, and Moving Averages.

- Customizable charts for different timeframes (minutes, hours, days).

- Social features allow you to see community insights and trading ideas.

How to Use:

- Sign up for a free account.

- Type “DOGE/USD” or “DOGE/BTC” in the search bar.

- Use the “Indicators” button on the top panel to add RSI, MACD, and moving averages.

2. Binance

- Website: Binance

- Features:

- One of the largest cryptocurrency exchanges.

- Built-in charts with technical indicators and analysis tools.

- You can trade Dogecoin directly while analyzing the price and market trends.

How to Use:

- Create an account and deposit funds (if you haven’t already).

- Search for Dogecoin (DOGE) in the market tab.

- Use the charting tools on the right to add indicators like RSI and MACD.

3. CoinGecko or CoinMarketCap

- Websites: CoinGecko | CoinMarketCap

- Features:

- These platforms provide real-time data on Dogecoin and other cryptocurrencies.

- They don’t have advanced charting features like TradingView, but you can view price changes and historical data.

4. MetaTrader 4/5 (MT4/MT5)

- Website: MetaTrader

- Features:

- Popular for forex trading, MT4/5 allows you to trade cryptocurrency (including Dogecoin) on supported brokers.

- Provides advanced charting and technical analysis tools, including RSI, MACD, and other indicators.

How to Use:

- Download the MetaTrader app or platform from the website.

- Add your crypto broker account to access Dogecoin pairs.

- Use the charting tools to add indicators for analysis.

5. Mobile Apps for Quick Access

- Binance App (Android/iOS): Offers live charts with indicators for Dogecoin.

- TradingView App (Android/iOS): Allows you to track charts and apply technical analysis on the go.

- Blockfolio (FTX): A portfolio tracker with price alerts and some basic charting features.

Summary:

For detailed and interactive charting, TradingView is the best option. It’s free, user-friendly, and highly customizable. If you want to trade and analyze in the same place, Binance or MetaTrader might be more suitable.

Once you’ve selected your platform, you can easily plot the Dogecoin chart and start applying technical indicators to recognize good buy or sell signals.

Recent Comments